What Happens If You Die Without a Will in Arizona?

It’s not something we like to think about, but what actually happens to your home equity, accounts, and personal belongings when you pass away? In you die without a will in Arizona, the state legislature’s default laws of intestacy decides who inherits all your property. In some situations, this might work just fine for your family. But as an estate planning attorney at Windrose Law Center, I have seen firsthand some of the negative consequences including permanently broken relationships, family disputes, and expensive (and often dramatic) probate proceedings. In this post, I will break down exactly what happens under Arizona law and explain how you can protect your loved ones, eliminate probate, preserve family peace and maintain control over your legacy so that everyone’s last memory of you is not the drama of probate court.

What Does It Mean to “Die” Intestate in Arizona?

When you pass away without a valid legal document in place, you are considered to have died "intestate" under state law. This means that Arizona probate courts must follow a rigid, pre-determined formula to distribute your assets, rather than following your personal wishes. This means that Arizona’s laws of intestacy decide who gets your assets rather than you being the one who decides.

The laws around what constitutes a valid will can be found in Chapter 2 of Title 14 of the Arizona Revised Statutes as interpreted and applied by case law from the Arizona Court of Appeals and Arizona Supreme Court. Probate courts are the courts of the Arizona Superior Court. Each county has at least one of their own probate courts. For example, a person who dies in Scottsdale or Peoria would have their estate go through the Arizona Superior Court of Maricopa County.

Who Inherits Your Assets Under Arizona Intestacy Laws?

According to the Arizona Revised Statutes, your property is distributed to your "heirs at law" based on a specific priority list. Without a custom plan, your home equity, bank accounts, and personal belongings may end up with relatives you haven't spoken to in years or be split in ways that cause financial hardship for your closest loved ones.

In most cases, your estate will go through probate which is the court supervised process of transferring property after someone dies. I’ve seen too many times where the memory of a loved one is tainted by this stressful process. Probate takes months to complete and often adds stress to an already difficult time for your loved ones.

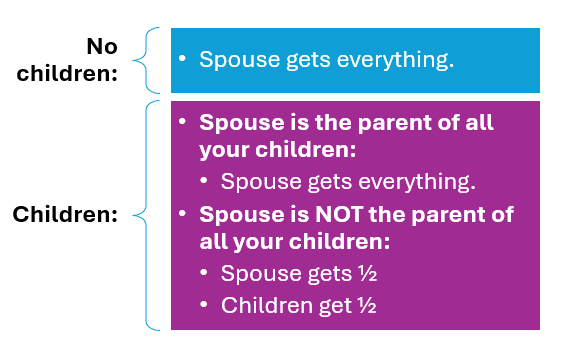

The Arizona Revised Statutes’ laws of intestacy create a priority list for who inherits your property.

If You Have a Surviving Spouse:

If You Do Not Have a Spouse:

If you have never been married, are legally divorced, or if your spouse passed away, your parents, then siblings would receive your assets.

How Dying Without a Will Affects Blended Families in Arizona

If you have children from a previous relationship, blended families in Arizona face unique risks under the state's default distribution rules. Often, a surviving spouse and children from a prior marriage are forced to share assets, which can lead to complex legal disputes and permanently strained family relationships.

This default distribution often surprises people, especially blended families. If you have remarried or have children from a previous relationship, Arizona’s “one size fits all” system probably does not reflect your wishes.

Protecting Your Children: Guardian and Financial Oversight

One of the most overlooked consequences of dying without a will in Arizona is what happens to your minor children?

Perhaps the most critical risk of dying intestate is leaving the care of your minor children up to a judge's discretion. Without wills and trusts in Arizona that clearly name a guardian, the court will decide who raises your children—and your ex-spouse may gain full control over the inheritance you intended for your kids. Without a valid will naming a guardian, the court will decide who raises your children. While the court considers what’s in their “best interests,” there’s no guarantee it will choose the person you would have trusted most.

Even if you are divorced and your child’s other parent is still living, they will continue to care for your child but what about any money you leave behind? Often times, it means that your exhusband or exwife would be the one managing any asstes you leave behind.

This default distribution can be avoided. Instead you can take control over what happens if you:

• Name a guardian to care for your children

• Provide financial protection with a trust

• Avoid family disputes over custody

If you’re a parent, making your wishes clear now is one of the most important gifts you can give your children

References:

Arizona Revised Statutes

Title 14: Trusts, Estates, and Protective Proceedings

https://www.azleg.gov/arsDetail/?title=14

How to Avoid Probate in Arizona and Maintain Control

How do you avoid all of these defaults? The good news is that avoiding probate in Arizona is entirely possible with a proactive estate plan. By using tools like a revocable living trust, you can ensure your assets transfer directly to your beneficiaries immediately, privately, and without the need for a costly court process. While dying without a will almost always results in probate, there are several planning tools available in Arizona to help you avoid probate, protect your family, and maintain control over your estate:

1. Create a Revocable Living Trust

Allows your assets to transfer outside of probate.

Lets you control when and how your beneficiaries receive their inheritance.

Especially helpful for blended families or second marriages.

2. Add Pay-on-Death (POD) and Transfer-on-Death (TOD) Designations

Applies to bank accounts, investment accounts, and other assets.

Ensures funds go directly to your beneficiaries without court involvement.

3. Establish Powers of Attorney

Protects you and your family during incapacity.

Ensures someone you trust can handle financial or medical decisions.

Each of these tools can work together to create a comprehensive estate plan tailored to your family’s needs which is something Arizona’s intestacy laws can’t do.

When Probate May Still Be Required

Even with planning, some estates still go through probate. For example:

If assets aren’t properly titled or updated.

If there are disputes between heirs.

If creditors make claims against the estate.

The good news? With careful planning, you can significantly reduce probate costs and delays and sometimes avoid it entirely.

Consult an Experienced Arizona Estate Planning Attorney

If you’ve been meaning to “get around to it,” you’re not alone. Many people delay estate planning because they think they’re too young, don’t have “enough” assets, or believe their family will “figure it out.”

The reality is, Arizona’s default plan may leave your loved ones facing:

Long and expensive probate proceedings.

Conflicts between family members.

Outcomes you never intended.

Taking time now to create a plan gives you peace of mind and protects your family from unnecessary stress and expenses.

If you do not create a valid estate plan, Arizona has a plan for you but it might not be one that you would choose.

Whether you are looking for an estate planning attorney in Scottsdale or need help avoiding probate in Peoria, Windrose Law Center is here to help.